Unlevered Free Cash Flow Vs Fcff. What is the difference between unlevered vs levered fcf yield? Unlevered free cash flow is the money that is available to pay to the shareholders, as well as the debtors.

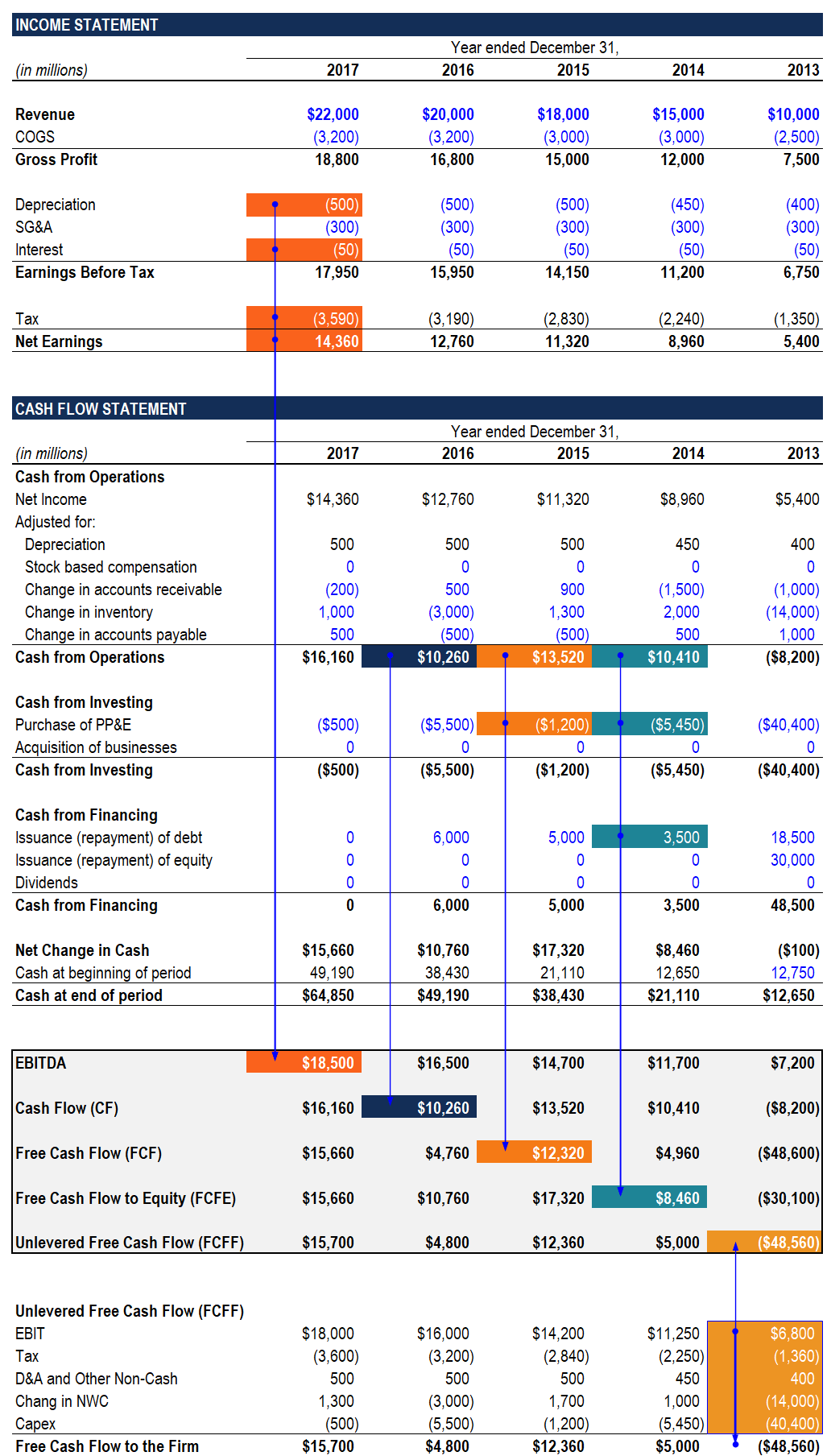

It is the cash flow available to all equity holders and debtholders after all operating expenses, capital expenditures, and investments in working capital have been made. Ufcf is calculated as ebitda minus capex minus working capital minus taxes. Unlevered free cash flow unlevered free cash flow is a theoretical cash flow figure for a business, assuming the company is completely debt free with no interest expense.

Ufcf can be reported in a company's financial statements or.

The fcff and fcfe which are acronyms for (free cash flow for the firm) and (free cash flow to equity), are the two types of free cash flow measures. Based on whether an unlevered or levered cash flow metric is used, the free cash flow yield denotes how much cash flow that the represented investor group(s) are collectively entitled to. Unlevered free cash flow is the money that is available to pay to the shareholders, as well as the debtors. If the company is not paying dividends;