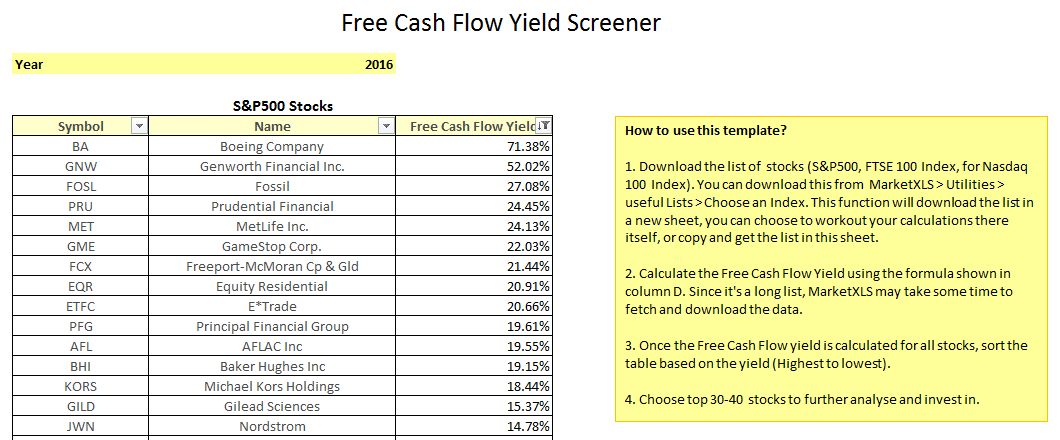

Free Cash Flow Yield S&p 500. Free cash flow yield is a financial ratio that standardizes the free cash flow per share a company is expected to earn as compared to its market value per share. The free cash flow yield is the total free cash flow / market capitalization.

On the trailing twelve months basis s&p 500 's pace of cumulative 12 months free cash flow growth in 3 q 2021 accelerated to 17.61 % year on year, above average. Now, to calculate the free cash flow yield, we divide the free cash flow by the market cap of the company. The free cash flow yield is the total free cash flow / market capitalization.

Free cash flow growth y/y annual comment:

Companies part of a certain industry/sector and dividing it by the total market capitalization of the companies. On the trailing twelve months basis s&p 500 's pace of cumulative 12 months free cash flow growth in 3 q 2021 accelerated to 17.61 % year on year, above average. The trailing fcf yield for the s&p 500 fell from 2% at the end of 2019 to 1.2% as of 3/23/21, the earliest date 2020 annual data was provided by all s&p 500 companies. For reference, we analyze the core earnings for each s&p 500 sector.